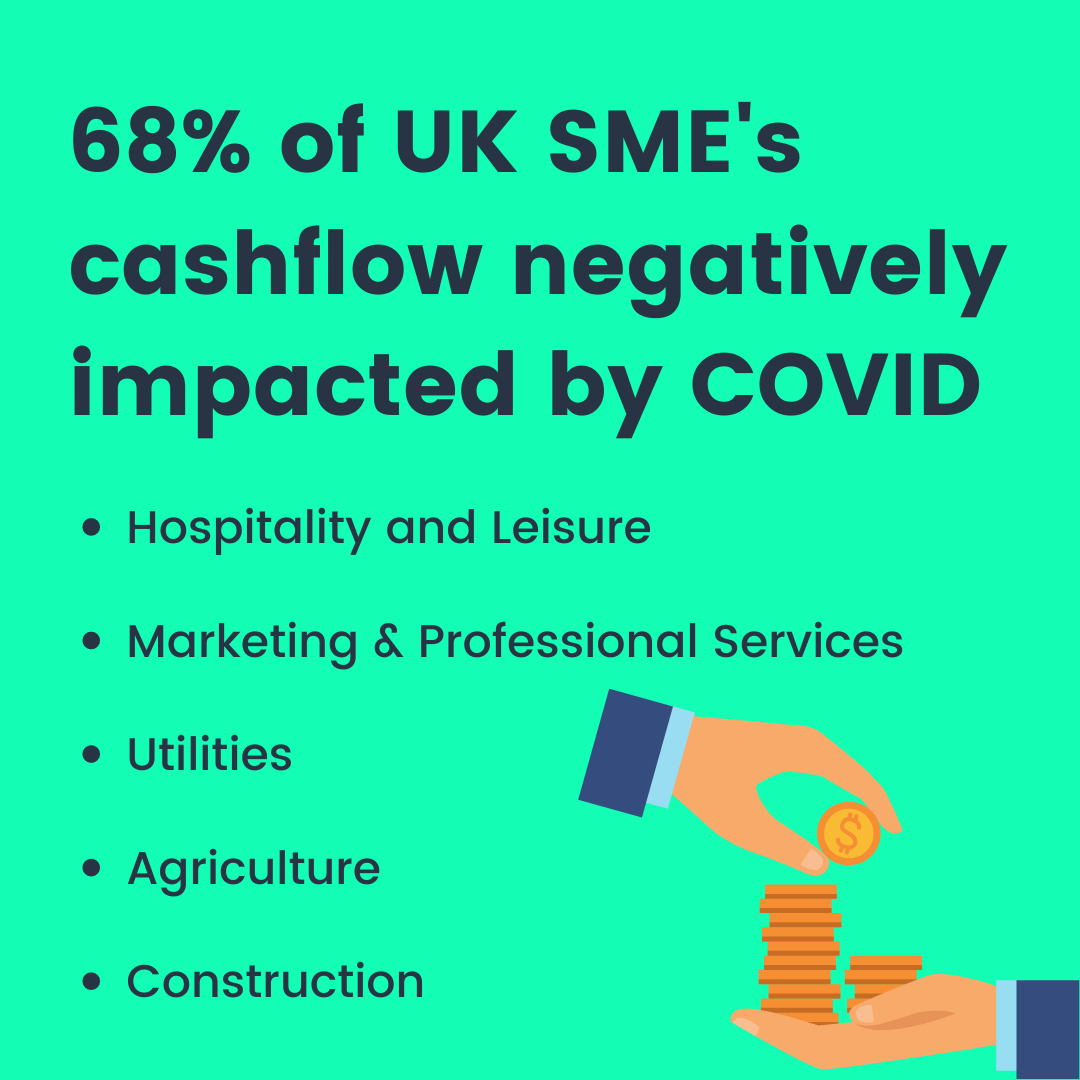

68% of UK SME’s Cashflow Negatively Impacted by COVID

One of the Europe’s largest online-only lending platforms, Capital Box, completed a survey which revealed the devastating effects of the pandemic on small and medium businesses in the UK.

The survey presented that 68% of small and medium businesses in the UK have had their cash flow negatively impacted due to the pandemic. Those that have had their cash flow impacted said they were unable to reinvest in their business to help survive the recession (34%), unable to pay employees (26%), had to turn down work and client jobs (25%) and haven’t been able to cover debt or loan repayments (15%).

The impact of cashflow has come from multiple lockdowns, the increase in household saving and the shift in consumer needs.

In response, SMEs in the UK have had to take a number of measures to cut costs such as: pausing and stopping future projects (36%), reducing staff hours (26%), reducing staff pay (25%), cutting office perks (25%) and reducing office space overheads (20%).

In addition to making cuts, 56% of SMEs in the UK have had to take out a loan during the last year to help pay for overheads (39%) and to pay wages (20%).

During one of the hardest years for many business owners, Government support has been critical. The support that was offered was taken up by many, whether that be the furlough scheme (55%), tax relief (36%) or government back loans (43%).

Which businesses were affected negatively the most?

- Hospitality and Leisure – 34%

- Utilities – 32%

- Agriculture – 22%

- Marketing and Professional Services – 21%

- Construction – 20%

With the UK Roadmap to Recovery going to plan, hopefully many businesses will be opening back up again. If you’re planning on opening and struggling with cashflow at the moment due to the UK’s restrictions, why not speak to a member of our team? We have a number of finance options which may help your business such as the Government’s Recovery Loan Scheme or Invoice Finance. Complete our contact us form or call us on 01270 443510