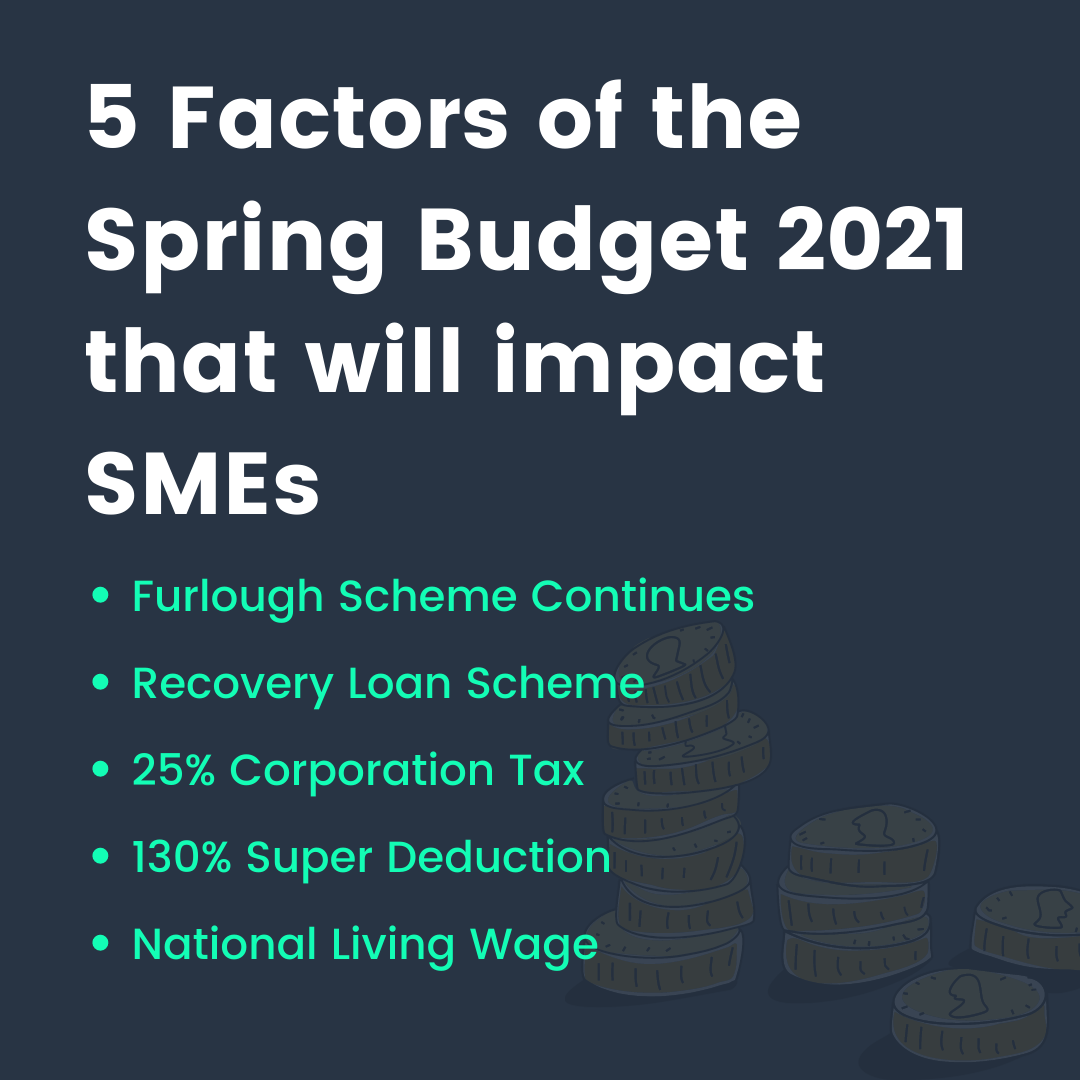

5 Factors of the Spring Budget 2021 that will impact SMEs

The Government have said that Chancellor Rishi Sunak’s Spring Budget which was announced on the 3rd of March 2021 will deliver an investment lead recovery.

The budget was about how to help the country and businesses recover from the impacts of the Coronavirus pandemic; we have highlighted five points of the budget which will have an impact on SMEs.

Furlough scheme continues to September

Even though the Government’s roadmap of Recovery aims to have normality for the country by the 21st of June, the furlough scheme has been extended to 30th September. In July, employers will have to contribute 10% of wages, increasing to 20% in August.

Extending the furlough scheme will mean that employees will still be receiving an income whilst businesses try and get themselves running at 100% again.

New Government backed loan scheme – Recovery Loan Scheme

We’re sure by now, you would of heard about the Recovery Loan Scheme which came available to UK businesses on the 6th of April 2021. This loan scheme will be replacing previous schemes such as the Coronavirus Business Interruption Loan Scheme (CBILS). Like the previous scheme CBILS, there is a no personal guarantee of up to £250,000 however the Recovery Loan Scheme is available to businesses of any size!

25% corporation tax from 2023

From April 2023, corporation tax will increase to 25% from its current level of 19%. The rate will remain at 19% for companies with annual profits below £50,000. The Government have said that this will affect around 70% of actively trading companies.

130% super-deduction on plant and machinery investment

Until March 2023, companies who invest in qualifying new plant and machinery assets can claim at 130% super-deduction capital allowance. The idea behind the super-deduction is to encourage businesses to invest in productivity enhancing plant and machinery assets that will help your business grow.

What qualifies under the Super deduction tax?

There is not an exhaustive list of plant and machinery assets. We have put together a list of the kind of assets which may qualify but are not limited to:

- Solar panels

- Computer equipment and servers

- Tractors, lorries, vans

- Ladders, drills, cranes

- Office chairs and desks

- Electric vehicle charge points

- Refrigeration units

- Compressors

- Foundry equipment

Increases in the national living wage

Eligibility for the top rate of the National Living Wage will be lowered to those aged 23 and over. The rate of pay for this age group has raised from £8.72 per an hour to £8.91. Rates for younger employees will also increase.

If you’re looking for new plant and machinery for your business and would like more information about asset finance, speak to our experts today. Additional, we will be able to assist you with the Recovery Loan Scheme alongside other finance options such as Bridging Finance, Development Finance, Invoice Finance and much more!