Case Studies

Case Study Highlights:

The following is a showcase of some of our client case studies and a demonstration of the vast range of business finance we can arrange across a multitude of industries.

We’re proud to have built a reputation as solution finders and often find solutions that other brokers cannot see. With 5 star reviews, our clients enjoy our exceptional services and we always go the extra mile to make the process as stress free as possible.

Property Finance Case Studies

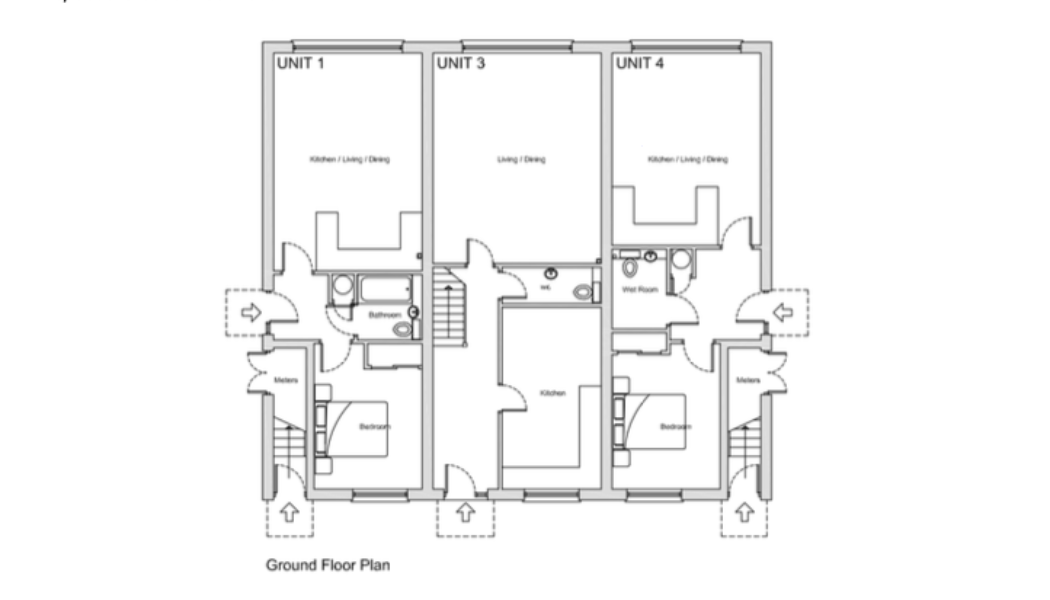

Development Finance - £979,000

Our client owns a piece of land worth £200,000 and they gained planning permission to build 5 apartments.

- £979,000 Development Loan

- The apartments will be worth £1,540,000 once completed

- Funding was agreed upon in 10 drawdowns agreed over an 18 month period

Commercial Mortgage - £350,000

A 40 unit rental holiday park in the heart of Cornwall was our client’s latest business venue and we were so pleased that we were able to arrange finance for their new business endeavour.

- £350,000 Commerical Mortgage (Interest Only)

- 30 Year Term

- Purchase of the holiday park & associate management business

Cash Flow Finance Case Studies

Unsecured Business Loan - £125,000

The owners of a Business and Leisure Centre approached us for funding to install solar panels on their commercial property to reduce their carbon footprint and also their energy bills.

- £125,000 Unsecured Business Loan

- 72 Month Term

- £2,375 Monthly Repayments

Unsecured Business Loan - £188,733

Our client are a successful bakery business who were looking for funding for its ambitious growth plans including supplying their goods to a very popular high street department store.

- £188,733 Unsecured Business Loan

- 72 Month Term

- No personal guarantees connected to the finance agreement

Acquisition Loan - £220,000

Our client approached us to assist in financing the acquisition of a Quantity Surveying Business.

- £220,000 Acquisition Loan

- 72 Month Term

- £4,339 Monthly Repayments

Acquisition Finance - £1,400,000

Our client approached us looking to purchase a 75% share of a company via a management buy in.

- £1,400,000 funding agreed

- 6 Year Term

- 4.45% margin over the Bank of England’s Base Rate

Cashflow Finance - £115,000

Our client owns a domiciliary care business and they were looking for an injection of working capital.

- £115,000 Unsecured Business Loan

- 2 Year Term

Asset Finance Case Studies

Asset Refinance - £30,000

Our client came to us looking to refinance their existing ice-cream van worth £55,000 and the asset refinance provided them with a helpful injection of working capital.

- £30,000 Cash Injection

- 5 Year Term

- £678.73 monthly repayments

Hire Purchase - £18,220

A local garden maintenance business was looking to purchase a John Deere ride on mower to enable them to take on larger contracts and improve the efficiency of their mowing jobs.

- £18,220 Hire Purchase

- VAT Only Deposit

- 60 Month Term

Hire Purchase - £48,000

Our client came to us looking for finance to purchase a new commercial vehicle, a vehicle that could be used for client and supplier meetings.

- £48,000 Hire Purchase

- 36 Month Term

- The business will own the asset at the end of their finance agreement

Franchise Finance Case Studies

Franchise Buy In - £39,000

Our client was looking to buy into a franchise with a fee of £42,000 inclusive of VAT. After assisting our client with their cashflow forecast, they needed £36,000.

- The client required cashflow for the first 12 months of £36,000 and funding support of 50% of the total investment. Approximately, £78,000 over the term of the franchise agreement of 5 years.

- 5 Year Term with an interest fixed rate of 8.89%.

Franchise Resale - £100,000

- Franchise Funding for the purchase of a franchise resale.

- £100,000 finance facility with a £5,000 overdraft facility.

- 10 Year Term with an interest rate of 7.59%

Domiciliary Care Franchise Resale - £245,000

Our client was looking to purchase a domiciliary care franchise resale with an agreed purchase price of £280,000 and wanted additional funding to support the £70,000 cashflow needed for the first 12 months.

- 70% Loan to Value of Total funds needed.

- 10 Year Term.

Business Loan Protection

Business Loan Protection could give your business a financial lifeline in the event something was to happen to the owner of the finance agreement. If there are multiple directors or shareholders who have responsibility for the finance agreement, joint policies are available.

Our sister company Amplo Mortgages and Financial Solutions can arrange Business Loan Protection – as we’re under the same roof, don’t hesitate to get in touch with us and we will pass you on to our protection insurance specialist.

Address

Amplo Group

11 Mallard Court, Mallard Way,

Crewe, Cheshire, CW1 6ZQ

Join Our Mailing List

See our privacy notice for more information on how we take care of your information.